We are value investors looking to make absolute returns for our clients over the longer term.

We invest only in listed Japanese equities. We are pure stock pickers who follow a disciplined investment process. All our funds are managed collectively by our team of seven experienced fund managers. We apply the same investment process across all our accounts.

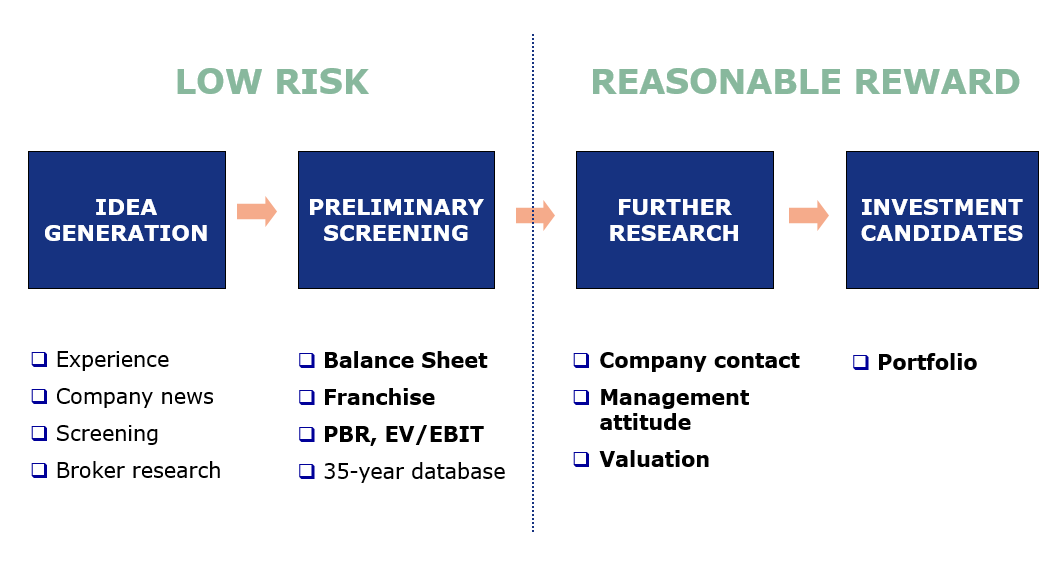

We aim to reduce the risk of capital loss by investing in companies with strong balance sheets, attractive business franchises and low valuations. We measure valuations primarily by a company’s price to book and enterprise value to operating profit ratios.

Importantly, our analysis of companies starts with the balance sheet. We prefer companies with net cash and investment securities, and we also take account of factors such as intangible assets, pension deficits and property.

We analyse a company’s business franchise to assess whether it is sustainable over the longer term. As part of this process, we typically carry out around 200 meetings and company conference calls each year in London and Japan. As well as operational issues, we are also interested in management’s attitude to shareholder returns as we believe this is an important driver of performance for our clients. ESG issues, particularly Governance, form an integral part of our company analysis, and we are increasingly engaging with companies on these subjects.

For our two yield funds (WS Morant Wright Nippon Yield and Morant Wright Fuji Yield), we look for stocks that meet the above criteria and also offer an above average dividend yield.

We fundamentally believe that companies with strong balance sheets are better placed to weather varied economic conditions, and also have greater potential to reward shareholders through increasing dividends and share buybacks. Japanese companies remain under increasing pressure to focus on shareholder returns, both because of government policies, such as the introduction of the Corporate Governance Code in 2014, and because of increased private equity activity and greater shareholder activism. Over time we believe that these factors, along with increased M&A activity, will lead to the realisation of the value in our stocks.